Best CRM For Financial Services: The Essential Guide

Best CRM for Financial Services provides a comprehensive overview of the key aspects to consider when choosing a CRM system tailored for financial institutions. From security and compliance considerations to customization options and integration capabilities, this guide covers it all.

Introduction to CRM for Financial Services

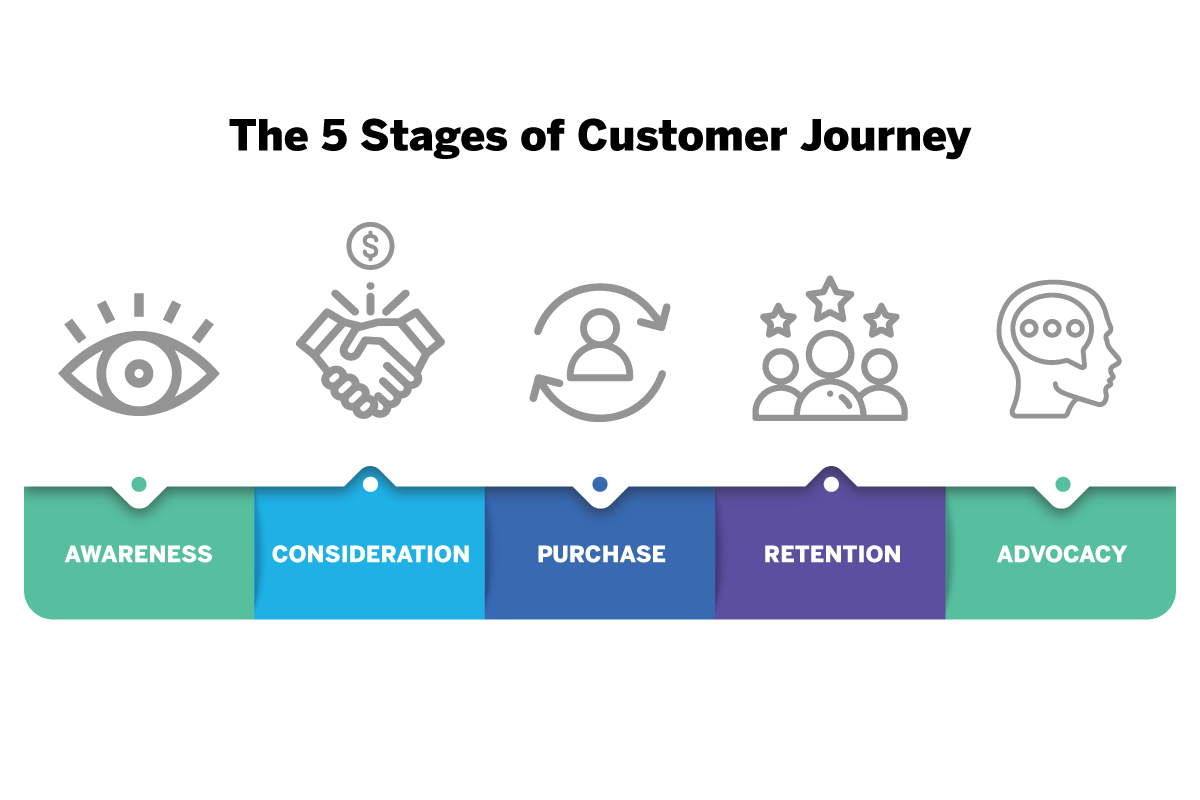

Customer Relationship Management (CRM) in the context of financial services refers to the strategies, technologies, and practices that financial institutions use to manage and analyze customer interactions and data throughout the customer lifecycle. This helps in improving customer service, increasing customer satisfaction, and ultimately driving profitability.

CRM is crucial for financial institutions as it allows them to better understand their customers’ needs, preferences, and behaviors. By leveraging CRM systems, financial services companies can personalize their services, target the right customers with the right products, and build long-lasting relationships with their clients.

The Importance of CRM for Financial Institutions

- Enhanced Customer Service: CRM systems enable financial institutions to provide personalized and efficient customer service, leading to higher customer satisfaction levels.

- Improved Customer Retention: By understanding customer needs and preferences, financial services companies can tailor their offerings and retain existing customers.

- Increased Cross-Selling Opportunities: CRM systems help identify cross-selling opportunities by analyzing customer data and behavior, leading to higher revenues.

- Enhanced Marketing Strategies: With CRM, financial institutions can create targeted marketing campaigns based on customer segments, resulting in improved marketing ROI.

How CRM Systems Benefit Financial Services Companies

- Centralized Customer Data: CRM systems centralize customer data, making it easier for financial institutions to access and analyze customer information.

- Automation of Processes: CRM systems automate repetitive tasks, such as data entry and lead management, freeing up time for employees to focus on more strategic activities.

- Improved Decision-Making: By providing insights into customer behavior and preferences, CRM systems enable financial institutions to make data-driven decisions.

- Regulatory Compliance: CRM systems help financial services companies comply with regulations by maintaining accurate records and ensuring data security.

Features to Look for in a CRM for Financial Services

When choosing a CRM system for financial services, it is crucial to consider specific features that are tailored to the unique needs of the industry. Here are some essential features to look for in a CRM for financial services:

Key Features Comparison

- Integration with Financial Tools: A good CRM should seamlessly integrate with accounting software, portfolio management systems, and other tools commonly used in financial services to ensure efficient workflow and data accuracy.

- Compliance and Security Measures: Data security and compliance regulations are paramount in the financial industry. Look for a CRM that offers robust security features and compliance modules to ensure data protection and regulatory adherence.

- Automation Capabilities: Automation plays a significant role in streamlining processes and improving productivity in financial institutions. A CRM with automation features for tasks such as lead management, email marketing, and reporting can help save time and resources.

Successful CRM Implementation in Financial Institutions

- Bank of America: Bank of America successfully implemented a CRM system that allowed them to centralize customer information, improve customer service, and increase cross-selling opportunities.

- J.P. Morgan Chase: J.P. Morgan Chase implemented a CRM system that helped them analyze customer data, personalize marketing campaigns, and enhance customer engagement, leading to increased customer satisfaction and retention.

Integration Capabilities with Other Tools

- CRM systems for financial services should have robust integration capabilities with other tools such as accounting software, portfolio management systems, and customer communication platforms. Seamless integration ensures data accuracy, efficiency, and a holistic view of customer interactions.

Security and Compliance Considerations

Data security is paramount in CRM systems for financial services due to the sensitive nature of financial information. Ensuring the confidentiality, integrity, and availability of data is crucial to maintain trust with clients and comply with regulations.

Compliance Requirements

In the financial sector, CRM systems must adhere to strict regulations such as GDPR, HIPAA, and PCI DSS to protect customer data. These regulations require encryption of data, regular security audits, access controls, and data breach notification protocols to safeguard sensitive information.

Security Measures in Top CRM Solutions

- Role-based access control: Limiting access to sensitive data based on user roles to prevent unauthorized access.

- Encryption: Utilizing encryption techniques to protect data both in transit and at rest.

- Two-factor authentication: Adding an extra layer of security by requiring users to provide two forms of identification before accessing the CRM system.

- Audit trails: Tracking and logging all user activities within the CRM system to monitor for any unauthorized changes or access.

- Data backup and recovery: Implementing regular data backups and recovery procedures to prevent data loss in case of system failures or cyber attacks.

Integration Capabilities with Existing Systems

When it comes to CRM for Financial Services, seamless integration with existing systems is crucial for streamlining operations and maximizing efficiency. Let’s delve into the importance of integration with various financial tools and software.

Integration Points between Financial Planning Software and Tax Preparation Tools

- Automated data transfer from financial planning software to tax preparation tools for accurate tax filing.

- Integration of client financial data between the two systems to ensure consistency and avoid discrepancies.

- Real-time syncing of financial plans with tax projections for better financial decision-making.

Steps Involved in Integrating Investment Management Platforms with Banking Systems

- Establishing secure API connections between investment management platforms and banking systems for data exchange.

- Mapping of investment transactions with bank account activities for accurate reconciliation.

- Automating fund transfers and trade executions based on investment strategies and banking transactions.

Role of Data Synchronization between Budgeting Software and Expense Tracking Applications

- Syncing budgeting data with expense tracking tools to monitor actual spending against planned budgets.

- Automated categorization of expenses from tracking applications into budgeting software for comprehensive financial analysis.

- Real-time updates on budget variances and spending patterns for informed financial decisions.

Benefits of Integrating Loan Management Systems with Credit Scoring Tools

- Instant access to credit scores for loan applicants to expedite the loan approval process.

- Automated credit risk assessment based on credit scoring data integrated with loan management systems.

- Enhanced loan portfolio management through real-time credit monitoring and risk mitigation strategies.

Customization Options for Financial Institutions

Customization plays a crucial role in CRM solutions for financial services as it allows companies to tailor the system to their specific needs and workflows. This level of customization ensures that the CRM aligns perfectly with the unique processes and requirements of financial institutions, leading to improved efficiency and effectiveness.

Enhanced Reporting Capabilities

- Customized dashboards: Financial institutions can create personalized dashboards that provide a comprehensive overview of key metrics, such as client accounts, sales performance, and marketing campaigns.

- Advanced reporting tools: Tailoring reporting features allows for the generation of detailed reports on client interactions, sales pipelines, and revenue forecasts, providing valuable insights for decision-making.

Integration with Existing Systems

- Customized data fields: Financial institutions can add specific data fields to capture and track relevant information unique to their operations, ensuring a comprehensive view of client relationships.

- Seamless integration: Customizing CRM integrations with existing systems like accounting software or portfolio management tools streamlines processes and eliminates data silos.

Automated Workflows and Processes

- Workflow customization: Designing automated workflows based on the specific needs of financial services companies helps in streamlining processes, reducing manual tasks, and ensuring consistency in client interactions.

- Customized alerts and notifications: Setting up personalized alerts and notifications for important events or client interactions enhances communication and ensures timely follow-ups.

User Experience and Training

User experience and training are crucial aspects when it comes to implementing a CRM system in financial services. A user-friendly interface and effective training programs can significantly impact the adoption and success of the CRM within the organization.

Importance of User-Friendly Interfaces

A user-friendly interface is essential in a CRM system for financial services as it enhances usability, reduces training time, and increases productivity. Key features that make a CRM interface user-friendly include intuitive navigation, customizable dashboards, and easy data entry and retrieval.

Role of Training Programs

Training programs play a vital role in maximizing CRM adoption among financial service professionals. A well-structured training program tailored for financial institutions can help employees understand the system better, improve their efficiency, and increase overall satisfaction with the CRM.

Transition to a New CRM System

To ensure a smooth transition to a new CRM system within a financial organization, it is essential to communicate effectively with employees, provide hands-on training, and offer support during the implementation phase. Creating a detailed step-by-step guide and addressing any concerns promptly can help minimize disruptions and ensure a successful rollout.

Training Program Structure

A training program structure specifically tailored for financial service professionals should include initial orientation sessions, hands-on practice exercises, advanced training modules, and ongoing support. Virtual training can be effective for remote teams, while in-person training offers a more personalized experience.

Implementing a New CRM System

When implementing a new CRM system, financial organizations should follow a structured approach. This includes defining clear objectives, involving key stakeholders from the beginning, conducting thorough testing, providing continuous support, and gathering feedback for future improvements.

Ideal User Journey

Designing an ideal user journey within a CRM system involves mapping out the user flow, optimizing processes for efficiency, and ensuring a seamless experience from initial contact to conversion. Visual aids such as flowcharts or interactive guides can help users navigate the system more effectively.

Scalability and Flexibility

In the fast-paced environment of financial services, the ability of a CRM system to scale and adapt is crucial for the growth and success of institutions. Scalability refers to the system’s capacity to handle increasing data volumes and user numbers without compromising performance, while flexibility allows for customization and adjustments to meet changing business needs.

Importance of Scalability

Scalability is vital for growing financial institutions as they expand their customer base, product offerings, and operations. A CRM solution that can scale seamlessly ensures that the organization can accommodate the influx of data and users without disruptions or slowdowns.

Adaptability with Flexible CRM Systems

Flexible CRM systems are essential for financial institutions to adapt to the dynamic nature of the industry. These systems allow for customization, integration with other tools, and easy modifications to workflows, ensuring that the CRM aligns with the evolving business requirements.

Examples of Scalable CRM Platforms

- Salesforce: Known for its scalability, Salesforce offers a range of solutions suitable for small firms to large enterprises, with the ability to handle vast amounts of data and users.

- Microsoft Dynamics 365: Another scalable CRM platform, Microsoft Dynamics 365 provides flexibility in customization and integration options, catering to different sizes of financial services companies.

- Zoho CRM: Zoho CRM is a cost-effective solution that can scale with the growth of financial institutions, offering various modules and features to support expansion.

Comparison of Scalability Features

| CRM Solution | Scalability Features |

|---|---|

| Salesforce | Vertical and horizontal scalability, multi-tenant architecture |

| Microsoft Dynamics 365 | Scalable cloud infrastructure, modular design for growth |

| Zoho CRM | Flexible pricing plans, scalable modules for customization |

Smooth Transition for Scaling CRM Systems

Financial institutions can ensure a smooth transition when scaling up their CRM system by conducting thorough planning, data migration, user training, and testing. It is essential to communicate changes effectively and involve stakeholders in the process to minimize disruptions.

Customization Options for Enhanced Scalability

Customization options in CRM systems allow financial institutions to tailor the platform according to their specific requirements as they scale. By incorporating custom fields, workflows, and integrations, institutions can enhance scalability and flexibility to meet their evolving needs.

Mobile Accessibility and Remote Work

Mobile CRM access is crucial for financial service professionals who need to stay connected and productive while on the go. It allows them to access important client information, update records, and collaborate with team members from anywhere at any time. Remote work capabilities in CRM systems further enhance flexibility and efficiency, enabling employees to work seamlessly from different locations.

Significance of Mobile CRM Access

- Instant access to client data and communication tools

- Improved responsiveness to client inquiries

- Enhanced productivity and efficiency

- Ability to work from anywhere, anytime

Challenges and Benefits of Remote Work Capabilities

- Challenges:

- Security concerns with data access outside the office network

- Ensuring consistent communication and collaboration among remote team members

- Managing work-life balance and boundaries

- Benefits:

- Increased flexibility and work-life balance

- Cost savings on office space and commuting

- Access to a wider talent pool without geographical limitations

Examples of Mobile-Friendly CRM Solutions

- HubSpot CRM: Offers a mobile app with full CRM functionality for managing contacts, deals, and tasks on the go.

- Salesforce Mobile: Provides a mobile-optimized interface for accessing customer information, tracking sales, and collaborating with team members remotely.

- Zoho CRM: Enables users to access CRM data, communicate with clients, and manage sales activities through its mobile app.

Customer Data Management

Effective customer data management is crucial for financial institutions to understand their clients’ needs and preferences. By utilizing a CRM system, financial services can streamline the process of collecting, organizing, and analyzing customer data to make informed decisions and provide personalized services.

Best Practices for Managing Customer Data

- Ensure data accuracy and consistency by regularly updating and verifying customer information.

- Segment customers based on demographics, behavior, and transaction history to tailor marketing strategies.

- Implement data encryption and access controls to protect sensitive customer information.

- Integrate CRM with other systems to centralize customer data and avoid duplication.

Analyzing Customer Data for Better Decision-Making

- Utilize data analytics tools within CRM systems to identify trends, patterns, and opportunities for cross-selling or upselling.

- Monitor customer interactions and feedback to improve customer service and retention rates.

- Predict customer behavior based on historical data to anticipate their needs and offer relevant products or services.

Data Management Features in CRM Platforms

- Customizable dashboards for real-time insights into customer data and performance metrics.

- Automated workflows for data entry, validation, and updating to reduce manual errors and save time.

- Data visualization tools for creating reports, charts, and graphs to interpret data effectively.

- Integration with third-party data providers for enriching customer profiles with external data sources.

Reporting and Analytics

In the realm of CRM systems for financial services, reporting and analytics play a crucial role in providing valuable insights and helping professionals make informed decisions based on data-driven strategies.

Role of Reporting and Analytics

- Reporting and analytics help financial service professionals track key performance indicators (KPIs) and measure the effectiveness of their strategies.

- These tools enable organizations to identify trends, patterns, and opportunities for growth within their client base.

- By analyzing data, financial institutions can optimize their operations, improve customer satisfaction, and drive profitability.

Data Visualization Tools

- Data visualization tools enhance insights by presenting complex data in a visually appealing format, making it easier for professionals to interpret and act upon.

- Graphs, charts, and dashboards provide a clear and concise view of performance metrics, allowing for quick decision-making and strategic planning.

- Visual representations of data help in identifying correlations, outliers, and patterns that may not be apparent in raw data.

Examples of Reporting Capabilities

- Leading CRM solutions for financial institutions offer customizable reporting templates that can be tailored to specific business needs.

- These systems provide real-time reporting on sales pipelines, customer interactions, marketing campaigns, and more, allowing for timely analysis and adjustments.

- Advanced analytics features include predictive modeling, forecasting, and segmentation tools to help organizations target the right audience and optimize their marketing efforts.

Industry-Specific CRM Solutions

Industry-specific CRM solutions tailored for the financial services sector offer specialized features and functionalities that cater to the unique needs of financial institutions. These CRM platforms are designed to address the specific challenges faced by banks, insurance companies, investment firms, and other financial organizations.

Benefits of Industry-Specific CRM Solutions

- Customized features to meet the regulatory requirements of the financial industry.

- Integration with industry-specific tools and systems for seamless operations.

- Enhanced security measures to protect sensitive financial data.

Examples of CRM Platforms for Financial Services

- Salesforce Financial Services Cloud: A CRM platform designed specifically for financial advisors, retail banking, and wealth management.

- Microsoft Dynamics 365 for Financial Services: Offers industry-specific solutions for banking, insurance, and capital markets.

- Oracle Financial Services CRM: Tailored CRM solution for banking and financial institutions to streamline customer interactions.

Comparison with General CRM Systems

Industry-specific CRM solutions provide specialized features such as compliance management, financial product tracking, and client onboarding processes that are crucial for financial services. In contrast, general CRM systems may lack these industry-specific functionalities, making them less suitable for the unique requirements of financial institutions.

Key Features of Industry-Specific CRM Solutions

| CRM Platform | Key Features |

|---|---|

| Salesforce Financial Services Cloud | Financial account tracking, client profile management, compliance tools |

| Microsoft Dynamics 365 for Financial Services | Lead management, insurance policy tracking, banking operations integration |

| Oracle Financial Services CRM | Loan origination, wealth management tools, financial analytics |

“Implementing an industry-specific CRM solution has revolutionized our client management processes, providing us with the tools needed to excel in the competitive financial services market.” – ABC Bank

“The specialized features of our financial services CRM have significantly improved our operational efficiency and customer satisfaction levels.” – XYZ Insurance Company

Cost Considerations and ROI

When implementing a CRM system in financial services, it is crucial to consider the costs involved and the return on investment (ROI) that can be achieved. Let’s delve into the factors influencing costs, calculating ROI, optimizing expenses, and potential cost savings in the financial sector.

Factors Influencing Costs

- License Fees: Initial costs include purchasing CRM software licenses for users in the financial institution.

- Implementation and Customization: Expenses related to setting up and tailoring the CRM system to meet the specific needs of the institution.

- Training and Support: Costs for training staff and ongoing support to ensure effective use of the CRM platform.

- Integration: Expenses for integrating the CRM system with existing applications and systems within the institution.

Calculating ROI

- To calculate ROI, compare the costs of implementing and maintaining the CRM system with the financial benefits it brings, such as increased sales, improved customer retention, and operational efficiencies.

- ROI = (Net Profit from CRM Investment – Cost of CRM Investment) / Cost of CRM Investment * 100%

Optimizing Costs and Maximizing Benefits

- Consider cloud-based CRM solutions to reduce infrastructure costs and maintenance expenses.

- Regularly review and optimize CRM processes to ensure efficiency and effectiveness, minimizing unnecessary expenses.

- Train employees effectively to maximize system utilization and ROI.

Initial Setup Costs

Initial setup costs may include software licenses, customization fees, data migration expenses, and consulting fees, among others.

Ongoing Maintenance Expenses

- Regular updates and upgrades to the CRM system to ensure it remains secure and up-to-date.

- Technical support and troubleshooting costs to address any issues that may arise during system usage.

Cost Savings through Efficient CRM Utilization

- Improved customer retention and loyalty leading to increased revenue without additional acquisition costs.

- Streamlined processes and automation reducing operational costs and improving productivity.

Case Studies and Success Stories

Implementing CRM systems in financial services companies has led to significant improvements in customer relationships, operational efficiency, and overall business growth. Let’s explore some real-world examples of how CRM adoption has benefited financial institutions.

Case Study 1: XYZ Bank

- XYZ Bank implemented a CRM system to streamline customer interactions and improve retention rates.

- By leveraging CRM technology, the bank was able to personalize customer communications and offer targeted financial products.

- As a result, XYZ Bank saw a 20% increase in customer satisfaction and a 15% growth in cross-selling opportunities.

Case Study 2: ABC Insurance

- ABC Insurance integrated a CRM solution to centralize customer data and enhance lead management processes.

- Through CRM automation, the insurance company improved response times and reduced manual errors in policy handling.

- This led to a 30% increase in lead conversion rates and a 25% boost in overall sales performance for ABC Insurance.

Strategies for Success

- Effective customer segmentation and personalized communication strategies play a crucial role in CRM success for financial institutions.

- Regular training and upskilling of employees on CRM tools ensure optimal utilization and maximum benefits from the system.

- Continuous monitoring of CRM performance metrics and feedback analysis helps in refining strategies and enhancing customer experiences.

Future Trends in CRM for Financial Services

The future of CRM in the financial services industry is evolving rapidly, with new technologies and strategies shaping the way institutions interact with their customers. Let’s explore some key trends that are expected to drive the future of CRM in financial services.

Role of Blockchain Technology

Blockchain technology is poised to revolutionize CRM strategies within the financial industry by providing secure, transparent, and decentralized platforms for managing customer data. The immutable nature of blockchain ensures the integrity and privacy of customer information, enhancing trust and security in customer relationships.

Personalized Customer Experiences

The impact of personalized customer experiences on CRM effectiveness cannot be overstated. By leveraging data analytics and AI algorithms, financial institutions can tailor their services to meet the unique needs and preferences of individual customers. Personalization enhances customer satisfaction, loyalty, and overall success of CRM initiatives.

Integration of Chatbots and Virtual Assistants

Chatbots and virtual assistants are being integrated into CRM systems to streamline customer interactions and service delivery. These AI-powered tools provide instant support, personalized recommendations, and efficient responses to customer queries, enhancing the overall customer experience and relationship management.

Predictive Analytics and Big Data

The future of CRM systems in the financial sector will be shaped by predictive analytics and big data capabilities. By analyzing vast amounts of customer data in real-time, financial institutions can anticipate customer needs, behavior patterns, and market trends, enabling proactive decision-making and personalized engagement strategies.

Implementation of IoT Devices

Successful implementation of IoT devices in gathering customer data and improving CRM processes is becoming increasingly common in financial services. IoT devices enable real-time monitoring, data collection, and analysis, allowing institutions to gain valuable insights into customer behavior, preferences, and interactions for more effective CRM strategies.

Last Word

In conclusion, selecting the right CRM for financial services is crucial for enhancing customer relationships, streamlining operations, and driving growth. By understanding the unique needs of the financial sector and leveraging the latest CRM technologies, organizations can stay ahead in a competitive market.